All Categories

Featured

In 2020, an approximated 13.6 million U.S. houses are accredited financiers. These families regulate substantial wealth, approximated at over $73 trillion, which represents over 76% of all private wealth in the U.S. These investors join investment chances generally not available to non-accredited investors, such as financial investments in exclusive business and offerings by particular hedge funds, exclusive equity funds, and equity capital funds, which allow them to grow their riches.

Continue reading for details about the current certified capitalist modifications. Resources is the fuel that runs the financial engine of any kind of nation. Financial institutions normally fund the majority, however seldom all, of the funding required of any acquisition. There are scenarios like startups, where banks do not supply any kind of funding at all, as they are unverified and considered risky, however the demand for funding remains.

There are largely two rules that enable issuers of safeties to provide limitless quantities of protections to financiers. how to become an accredited investor uk. One of them is Rule 506(b) of Guideline D, which enables an issuer to sell safety and securities to endless recognized financiers and approximately 35 Sophisticated Financiers only if the offering is NOT made via basic solicitation and basic marketing

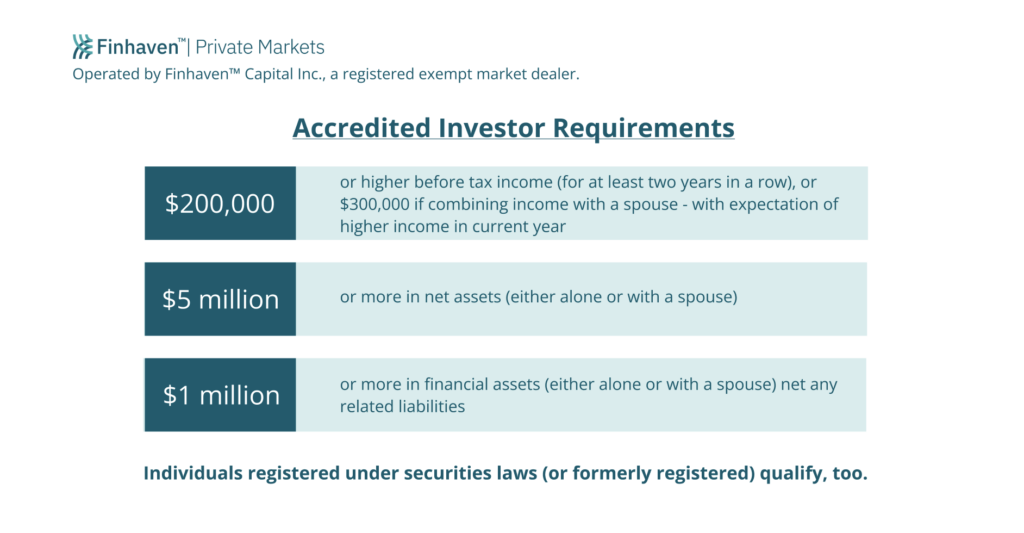

The newly embraced amendments for the initial time accredit specific investors based on economic elegance needs. The amendments to the accredited investor meaning in Regulation 501(a): consist of as recognized financiers any type of count on, with total possessions extra than $5 million, not formed specifically to acquire the subject safety and securities, whose acquisition is routed by a sophisticated person, or include as certified financiers any kind of entity in which all the equity proprietors are approved capitalists.

There are a number of registration exceptions that ultimately broaden the universe of potential investors. Lots of exemptions need that the investment offering be made just to persons that are recognized investors (if investor).

In addition, accredited financiers commonly receive extra favorable terms and higher possible returns than what is offered to the basic public. This is because personal positionings and hedge funds are not required to abide by the very same governing needs as public offerings, permitting more adaptability in terms of investment techniques and possible returns.

Accredited Investor Verification

One factor these protection offerings are restricted to certified capitalists is to guarantee that all participating investors are financially advanced and able to fend for themselves or maintain the threat of loss, hence rendering unnecessary the defenses that come from an authorized offering.

The web worth test is fairly straightforward. Either you have a million dollars, or you do not. On the earnings examination, the individual has to satisfy the limits for the three years constantly either alone or with a spouse, and can not, for example, satisfy one year based on private revenue and the following 2 years based on joint revenue with a spouse.

Latest Posts

What Is Tax Lien Certificate Investing

Tax Sale Properties Listings

Homes For Sale For Unpaid Taxes